As we approach another presidential election, many Americans are contemplating the potential changes in policies, economic stability, and market trends. One significant area that often experiences fluctuations during election periods is the housing market. Understanding the potential impacts of a presidential election on the housing market can help homebuyers, sellers, and investors make informed decisions.

Market Uncertainty

Elections inherently bring a degree of uncertainty, and the housing market is not immune to this. Leading up to an election, potential buyers and sellers might adopt a wait-and-see approach, leading to reduced market activity. This hesitation stems from uncertainties about future economic policies, tax reforms, and regulatory changes that could influence housing affordability and investment returns.

Policy Expectations

Presidential candidates often propose varying economic policies that can directly impact the housing market. These policies may include changes in:

- Interest Rates:

- The Federal Reserve's decisions on interest rates are influenced by the broader economic outlook, which can be affected by election outcomes. Lower interest rates generally make mortgages more affordable, potentially boosting home sales, while higher rates can have the opposite effect.

- Tax Policies:

- Proposals to modify tax deductions, such as the mortgage interest deduction, can significantly impact homeowners and buyers. Candidates’ stances on capital gains taxes also affect real estate investors and the attractiveness of housing investments.

- Housing Regulations:

- Policies related to zoning laws, affordable housing initiatives, and environmental regulations can influence the supply and demand dynamics within the housing market. Candidates’ views on housing development and urban planning play a crucial role here.

Economic Confidence

A presidential election can affect consumer confidence and spending behavior. If the election outcome is perceived as positive for economic growth, consumer confidence may increase, leading to higher demand for homes. Conversely, if the results raise concerns about economic stability, potential buyers might delay purchasing decisions, slowing down market activity.

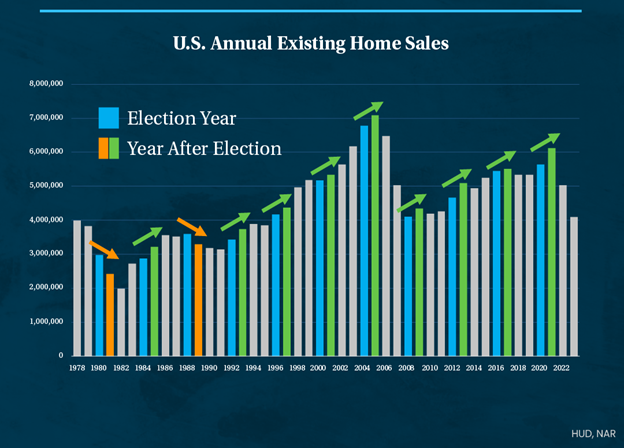

Historical Trends

Analyzing historical data provides insights into how past elections have influenced the housing market. According to data from HUD and the National Association of Realtors (NAR), home sales increased after 9 of the last 11 presidential elections. Typically, the housing market experiences a temporary slowdown in the months leading up to an election, followed by a rebound once the uncertainty diminishes.

Long-term Considerations

While elections can cause short-term fluctuations, it’s essential to consider long-term housing market fundamentals. Factors such as population growth, urbanization trends, and technological advancements in real estate continue to shape the market beyond election cycles. Therefore, making decisions based on long-term trends rather than short-term election impacts can be a prudent strategy for buyers, sellers, and investors.

Conclusion

The presidential election undoubtedly introduces elements of uncertainty and potential change in the housing market. By staying informed about proposed policies, historical trends, and the broader economic context, stakeholders can navigate these fluctuations more effectively. At Evergreen Home Loans, we are committed to providing our clients with the insights and guidance needed to make sound real estate decisions, regardless of the political climate. As always, we encourage you to reach out to our experts for personalized advice tailored to your unique situation.

Navigating the housing market during an election year can be complex, but with the right information and support, you can make informed choices that align with your long-term goals.

.svg)