Lately, talk of a possible recession has been all over the news—and it’s leaving many people wondering what that could mean for the housing market. If you’re thinking about buying or selling a home, you might be asking: Will home prices drop? Should I wait? What happens to mortgage rates during a recession?

At Evergreen Home Loans™, we believe informed decisions lead to confident choices. So let’s take a look at what history tells us about how recessions typically impact housing.

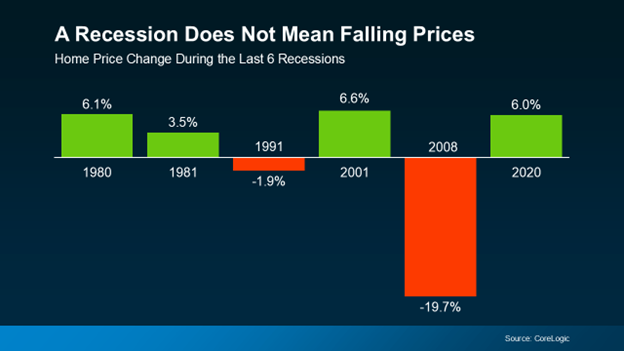

A Recession Doesn’t Always Mean Falling Home Prices

It’s easy to assume that a recession automatically leads to lower home prices—especially if you think back to 2008. But the housing crash during the Great Recession was the exception, not the norm.

According to data from CoreLogic, home prices increased during four of the last six recessions. In most cases, the housing market continued on its current path, and home values didn’t see dramatic declines.

So what does that mean for you? If you’re considering buying or selling a home, don’t let recession fears hold you back. Historically, home prices tend to remain steady or even rise during economic slowdowns—especially in markets with strong demand and limited inventory.

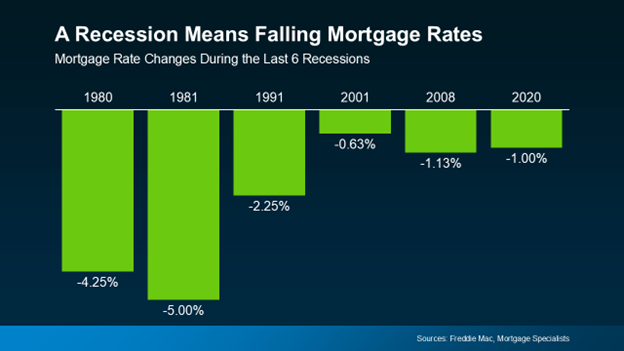

Mortgage Rates Usually Decline During Recessions

One trend that tends to repeat itself during recessions is lower mortgage rates. Over the past six economic downturns, interest rates dropped every single time.

Lower rates can be a silver lining in uncertain times—making home loans more affordable and increasing your purchasing power. That said, today’s market conditions are unique, and we don’t expect to see rates fall back to the 3% range. But even modest rate drops can make a meaningful difference in your monthly payment.

No one can say for certain if or when a recession will occur, but historical data offers helpful insight. The bottom line? A recession doesn’t automatically mean home prices will crash—and it may actually create an opportunity to lock in a lower mortgage rate.

At Evergreen Home Loans, we’re here to help you navigate the market with confidence. If you’re feeling unsure about what a potential recession means for your homebuying or selling plans, let’s talk.

Connect with your Evergreen Loan Officer today to get the answers you need and explore your options.

Source:KCM

.svg)