Why Now Might Be the Right Time to Buy a Home

If you’ve been holding off on buying a home due to high mortgage rates, it might be time to take another look at the market. Mortgage rates have been trending down recently, creating a new opportunity for buyers looking to make their move.

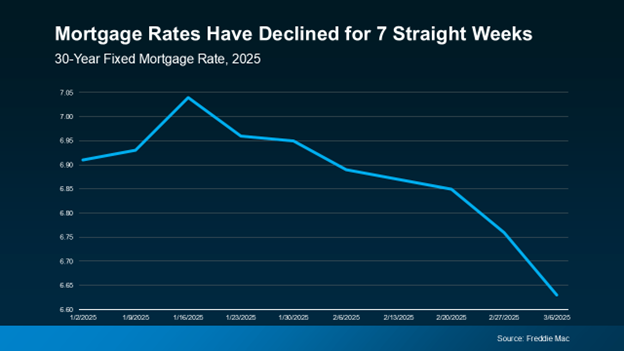

According to data from Freddie Mac, mortgage rates have declined for seven straight weeks, reaching their lowest point so far this year. While it may not seem like a drastic change, even a small drop in rates can significantly impact your purchasing power.

Why Are Mortgage Rates Declining?

Joel Kan, VP and Deputy Chief Economist at the Mortgage Bankers Association (MBA), explains that recent economic uncertainty has played a role in bringing rates down:

"Mortgage rates declined last week on souring consumer sentiment regarding the economy and increasing uncertainty over the impact of new tariffs levied on imported goods into the U.S. Those factors resulted in the largest weekly decline in the 30-year fixed rate since November 2024."

With spring homebuying season approaching, this dip in rates comes at an opportune time. However, mortgage rates can fluctuate quickly, meaning the current window may not last long.

What Lower Rates Mean for You

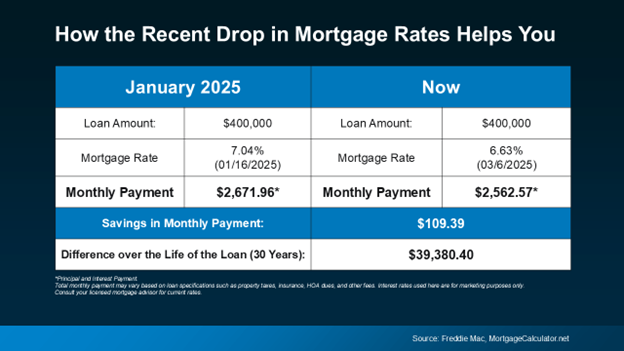

Even a small change in rates can impact your monthly mortgage payment. Consider this: if you were to take out a $400,000 loan, your payment at the peak rate of 7.04% in mid-January would have been significantly higher than what it would be at today’s lower rates. A decline to the mid-6% range can mean over $100 in monthly savings—money that could go toward home upgrades, savings, or everyday expenses.

Should You Wait or Act Now?

While many potential buyers are waiting for rates to drop even further, history has shown that market conditions can change unexpectedly. The recent rate drop happened faster than anticipated, but future fluctuations could bring rates back up. If you’re serious about buying a home, now could be the right time to take advantage of lower rates before they shift again.

Bottom Line

If a lower monthly payment makes homeownership feel more achievable, now is the time to explore your options. At Evergreen Home Loans, we’re here to help you navigate the mortgage process and find a solution that fits your needs.

Let’s break down the numbers together and see what’s possible for you in today’s market. Contact your local Evergreen Home Loans loan officer to get started!

Source: Keeping Current Matters

.svg)