In today’s media landscape, headlines about home prices can be confusing, making it tough to discern the reality of the market. Some predict a housing market correction, but what do the facts actually say? Let's break it down, starting with what a correction means in real estate.

What is a Market Correction?

Danielle Hale, Chief Economist at Realtor.com, clarifies:

“In stock market terms, a correction generally refers to a 10 to 20% drop in prices. We don't have the same established definitions in the housing market.”

In today’s housing market, a correction doesn’t mean prices will plummet. Instead, it means that prices, which have been rapidly increasing over the last few years, are starting to stabilize and grow at a slower pace. While prices can vary significantly by local market, a significant national decline isn't on the horizon.

The Real Estate Market is Stabilizing

Between 2020 and 2022, home prices surged due to high demand, low interest rates, and a limited supply of homes. However, this rapid growth was unsustainable. Today, we’re seeing a slowdown in price growth, indicating that the market is beginning to stabilize.

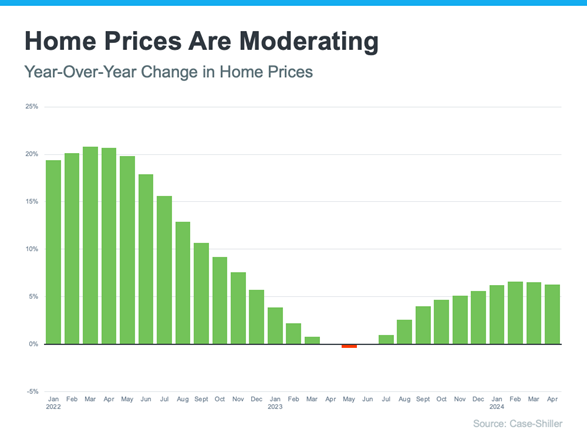

The latest data from Case-Shiller shows that while prices were flat for a few months last year, they are now rising again at a national level, albeit more slowly (see graph below):

A Healthier Pace of Growth

So far this year, we’ve observed a much healthier pace of price growth compared to the pandemic years. This normalization is good news for the market and for prospective homebuyers. But what does the future hold for home prices? Marco Santarelli, Founder of Norada Real Estate Investments, explains:

“Expert forecasts lean towards a moderation in home price growth over the next five years. This translates to a slower and more sustainable pace of appreciation compared to the breakneck speed witnessed in recent years, rather than a freefall in prices.”

It's all about supply and demand. With increasing inventory and limited buyer demand due to relatively high mortgage rates, some of the upward pressure on prices will ease.

What This Means for You

If you’re considering buying a home, the slowing price growth is encouraging news. The rapid price increases during the pandemic left many potential buyers feeling priced out. While it’s reassuring to know that the value of your home will likely continue to appreciate, slower price gains make homeownership more accessible. Odeta Kushi, Deputy Chief Economist at First American, notes:

“While housing affordability is low for potential first-time home buyers, slowing price appreciation and lower mortgage rates could help — so the dream of homeownership isn't boarded up just yet.”

At the national level, home prices aren’t dropping. Most experts forecast continued moderate growth. However, local markets can vary significantly. That’s why it’s crucial to have a trusted loan officer by your side. If you have questions about what’s happening with prices in our area, don’t hesitate to reach out to your local Evergreen Lender. We’re here to help you navigate the market with confidence.

Source: Keeping Current Matters

.svg)